Oracle Java: Renewal or Replacement?

The introduction of the Oracle Java SE Universal Subscription has created a bifurcation event in enterprise software strategy. By shifting from usage-based metrics (Processors/NUPs) to a strict “Employee” headcount metric, Oracle has effectively decoupled licensing costs from technical value. This article analyzes the financial impact of this shift and provides a detailed comparison of market alternatives.

1. The “Employee” Metric Deep Dive

Under the Java SE Universal Subscription Global Price List, the definition of a billable unit extends far beyond users of the software. It encompasses the entire organizational chart.

Critical Risk A retail chain with 50 Java developers and 15,000 store clerks must purchase 15,050 licenses. The cost is calculated on total headcount, regardless of actual Java usage.

2. Commercial & Technical Comparison

While Oracle locks pricing to company size, TCK-certified OpenJDK alternatives maintain the industry-standard “Pay for Usage” model. The following table contrasts the leading distributions.

| Vendor | License Metric | Pricing Model | Support Scope | Key Differentiator |

|---|---|---|---|---|

| Oracle | Total Headcount | $5.25 – $15.00 / mo / employee | Proprietary JDK + Support + Tools (JMC) | Legacy stability, but highest cost risk. |

| Azul Systems (Platform Core) |

Usage (vCore) | ~$25/Desktop/yr ~$200+/vCore/yr |

24/7 SLA, Out-of-cycle patches, TCK Certified | Widest support for legacy Java versions (6, 7). |

| BellSoft (Liberica JDK) |

Usage (vCore) | Usage-based Subscription | Spring Boot Optimized, Alpine Linux support | Default runtime for Spring Framework containers. |

| Amazon (Corretto) |

Free | $0.00 | Included if running on AWS Infrastructure | Best for AWS-heavy workloads. Production ready. |

| Red Hat (OpenJDK) |

Usage (Core) | Included with RHEL | Integrated OS-Level Support | Seamless if you already run RHEL/OpenShift. |

| Eclipse (Temurin) |

Open Source | $0.00 | Community (Best Effort) | True open source, no vendor lock-in. |

3. Applied Scenario: The 95% Delta

To illustrate the financial impact, consider “Enterprise X,” a logistics company with a large non-technical workforce.

- Total Headcount: 10,000

- Java Desktop Users: 500

- Java Servers (vCores): 200

- Non-Java Staff: 9,500

Formula: 10,000 Employees × $8.25/mo × 12

$990,000 / year

Based on Oracle 10k-19k tier pricing.

Desktops: 500 × $25 = $12,500

Servers: 200 × $200 = $40,000

~$52,500 / year

Based on standard market pricing for OpenJDK support.Switching yields an annual saving of $937,500 (94.6%).

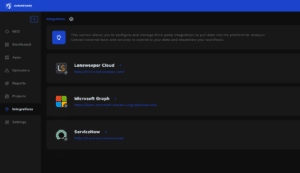

4. Automating the Decision Process

The decision to renew or replace cannot be made without accurate data. You need to know exactly which Java versions are running, who the vendor is (Oracle vs. OpenJDK), and whether they are running on physical or virtual hardware.

LICENSEWARE Collector

A lightweight, cross-platform utility that scans your infrastructure (Linux, Windows, macOS) to detect all Java installations.

- Identifies Vendor (Oracle, Azul, Red Hat).

- Detects Versions (Java 8, 11, 17, 21).

- Maps to Host Hardware (Physical/Virtual).

Oracle Java Discovery & Management

Import your data into OJDM to instantly visualize your licensing position.

- Simulates Oracle Universal Subscription costs.

- Identifies actionable migration candidates.

- Calculates potential savings from switching vendors.